Will the SEC Finally Capitulate to the Inescapable Grip of Diamond Hands? An MMTLP Press Conference Confronting Years of Regulatory Negligence and Collusion

Disclaimer: Everything below is a mix of what I observed and heard during the event. The goal isn’t to pinpoint "who exactly said what," but to share (usually) an outsider's view and overall perspective on these industries. I’m not here to act as a definitive firsthand source—readers should do their own research. I hope this inspires you to attend events, explore new industries, and hear what leaders are presenting. These notes combine my observations with thoughts on how things could run smoother and how ideas connect (IMO). I’m not an expert, you know? Just hanging out in the room with them. Enjoy!Topics: Stock Market, Transparency, Lying, Accountability, Government, Securities Exchange Commission, Negligence, Journalism, Activism, Secret Cooperation, Conspiring, Meme Stocks, GME, AMC, BBBYQ, MMTLP, Meta Materials, Torchlight, Mergers

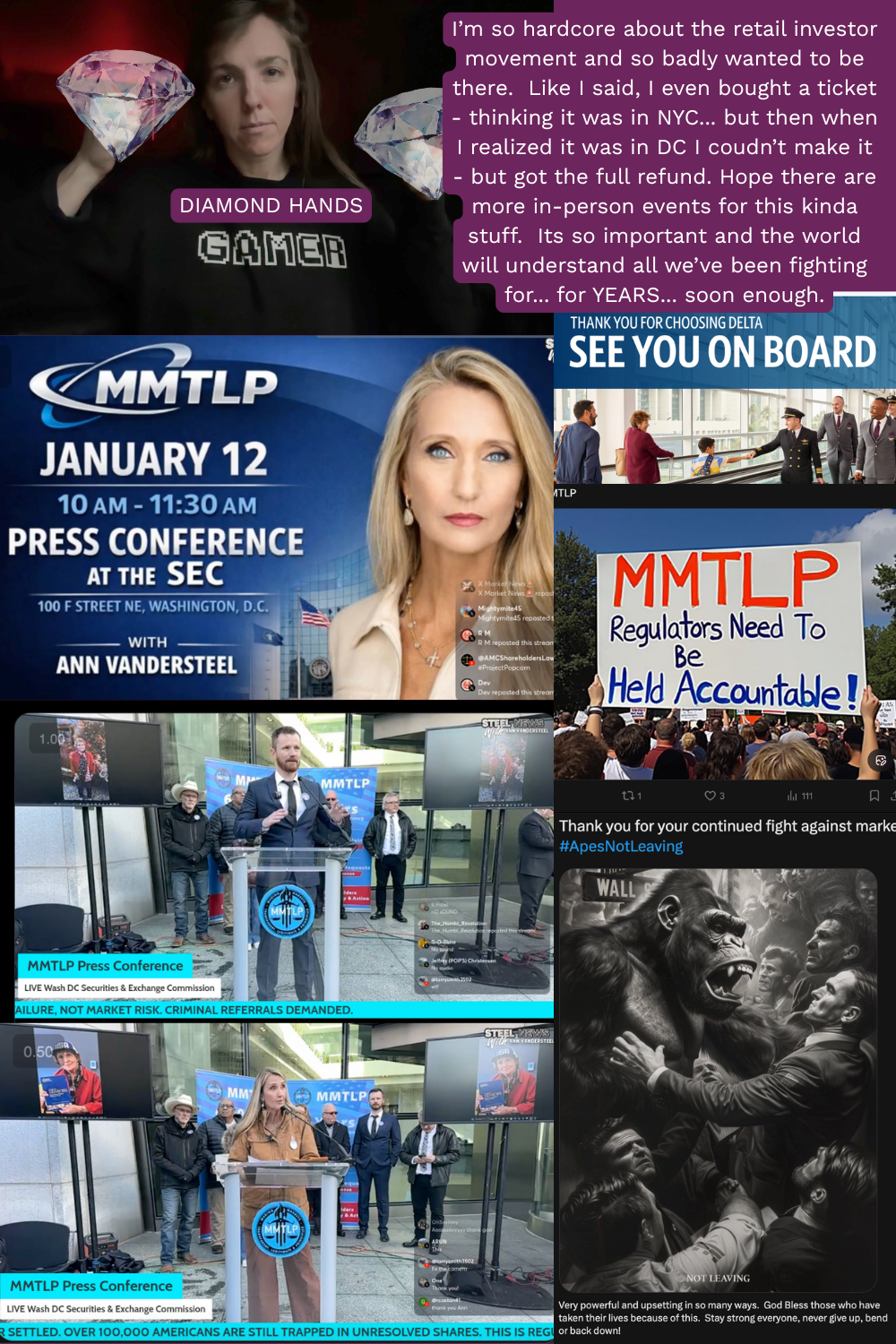

This event is one I wanted to attend more than anything I can think of lately. I even bought a plane ticket to go, but that was before I read through things carefully - thought it was going to be hosted in NYC… and then got a refund cause I realized it was in DC and you can get refunds within 24 hours of buying tickets. Then, I looked into flights for DC, but they were EVEN MORE expensive and like even more hours of flying, didn’t work with my schedule… so I just said, FINE! Alright!! I’ll just be obsessed with Twitter that day and see how it goes. So.. to take it one step further (cause I loved watching the press conference live) I want to write a full-fledged blog on it. I’ll write a lot of what people wrote and my thoughts on it, too.

Why Attend: Well, I’m not attending IRL, but I am watching the entire thing for a second time and writing about it, because this is a topic I’ve basically devoted most of my career-life to lately. The topic of transparency in the stock market. At first, I was epic at trading stocks, keeping up with gossip, and multiplying my investments by five or fifty times their worth. For real. However, once I saw the crime and corruption going on in the markets… like the day they didn’t let people buy GameStop, I just decided to stop my trading ways entirely, and invest as a warrior. To fight back against the crime and never stop until things change. It has been a long, lonely four/five years since… but I wouldn’t change a thing, and I like to think/see how we’re (the retail investors) making some impact finally, lately. I just don’t see how they can get away with these crimes while we don’t give up, don’t stop holding these shares, and refuse to capitulate. Heck! We’ve even learned words like “capitulate,” right? That’s no longer dumb money. We’re here to win and fight for a better future. To build/influence/embrace the markets we were raised/taught to believe in. Not today’s reality of dark pools, lies, and bribery to collude. So, this press conference outside of the SEC was a demand for accountability for manipulating markets and ignoring/mocking those who refuse to let the crimes be forgotten.

PHOTO COLLAGE & COMMENTARY:

NOTES FROM THE EVENT:

LINK HERE: https://x.com/LuckyCordle/status/2010731731008299276?s=20

The press conference was hosted on twitter. There is hype-music going which kept playing as she started to talk (and lasted for about the first 10 minutes) which was pretty distracting, but.. whatever.

I’ll write down a lot of what people said here.

Up first to talk is the woman who came up with the idea to host this event. She goes up to the microphone/podium to introduce herself.

You can see people in the chat talkign about AMC and MMTLP

She says goodmorning. Welcome to the SEC Commission. Also known as the scene of the crime.

hahah alrighttttt

She’s the co-founder of the American Made Foundation. She hosts a news group, too, looking at the regulatory fail and corruption, failing to protect the public.

Her partner is here as a documentarian and covering this humanitarian crisis and what happened because of the failures of the institution they stand in front of.

The cost of humans whose lives were disrupted and destroyed, as we’re about to hear.

Standing in front of the SEC for a reason… by their own words and documents, the SEC and FINRA engaged in conduct that enabled and concealed, defruadeding 10’s of thousands of investors in a stock that never should have been allowed to trade in the first place. This didn’t happen by accident.

She received a call back last year from an MMTLP investor. It was about frozen assets, missing shares, regulators refusing transparency, and a system protecting itself instead of the public.

That call made it clear that this was not an isolated event. It was another chapter in a larger pattern of regulator corruption and Americans being stripped of their rights and their property.

In June of 21, the stock was deemed nontradable (i don’t quite get this part they’re talking about)

Then her microphone falls and a guy works to try to fix it, cause it broke a bit - an extra microphone, but then its so loud. Because the mic is on while he tries to fix it.

FINRA allowed trading that was never authorized by the issuer, or registered by the SEC, and structurally incapable of a lawful settlement. Under SEC rules FINRA had a duty to reject this… and yet FINRA allowed the trading to proceed for more than a year. From 21-22, MMTLP had consistent failures to deliver.

Let me translate this to plain english for those who don’t understand financial jargon.

When someone sells a stock, they’re legally required to deliver the shares to the buyer within a few business days.

An occasional failure may occur, but when dozens occur day after day for months, tha’ts one of the strongest indicators that shares are being shared without being borrowed or without issuance at all. Commonly known as naked short selling.

Persistent failures to deliver were red flags that regulators could not ignore.

In 2022, the SEC approved a spin-off of the reverse merger, in December of 22 was the final trading day. That approval meant anyone who legitimately owned MMTLP, at the close of trading, was entitled to receive shares of the spinoff. But when FINRA halted trading early, the final share reconciliation never occurred. Leaving investors frozen and the company with an unbalanced shareholder ledger.

In December 2022, FINRA … (its so hard to hear her with this music playing, but I think it ends soon).

They froze investors’ shares. These positions remain unresolved today.

Why are we here? These are FINRA’s own words, they describe its mission: “FINRA’s mission is to protect investors and safeguard the integrity… to ensure that everyone can invest with confidence.”

In the case of MMTLP, FINRA did the opposite. Instead of protecting the investor, they allowed unauthorized trading. Trapping the good Americans and worldwide investors.

FINRA is a private, member-funded self-regulatory organization. They’re not even a government agency. Its board includes industry members from Wall Street who had exposure to MMTLP at the time of the halt. That conflict matters.

Why was the halt so illegal? FINRA tried to justify its actions with Rule 6490, but that does not authorize what they did. It doesn’t allow halting with settlement failures - protect Wall Street because they stole something they didn’t own.

it’s not supposed to shield market makers, brokers, or override SEC regulations.

MMTLP was violated for months without an ordinance.

Now she went off-screen really quickly as a woman went and interrupted her, then the music got turned off, and now she’s back.

The halt prevented forced closeout, which had sold shares they didn’t possess. It shielded them from mandatory buying as regulations show.

Believing they were buying legitimate equity, shareholders were left holding positions that could not be reconciled or delivered.

This is not unique to MMTLP, this was seen with Gamestop, with AMC, with Bed Bath and Beyond

Oh heck yeah, girlllll!!!!!!!!!!!

Deven Munez, the CEO of Trump Media tech group has publicly referenced MMTLP in warnings of abuse of naked short selling and regulatory failure.

Naked short selling distorts equities, undermines commodities like silver, and drains values from the real economy while regulators issue fines and allow regulators to keep up their ill-gotten gains.

What happened to MMTLP investors was not market risk; it was the failure of duty, a conflict of interest.

I am here to report the regulatory facts. My cofounder is here to meet and gather your stories on the human cost. Together, you’re going to get the full story.

Before I transition speakers, I want to recognize one of the thousands of special people and families harmed by this irregular U3 halt.

One family reached out to me immediately. I received a Christmas card, a drawing, and a letter from the family. And I also received this fantastic dog tag, representative of everybody in the MMTLP family, and I wear it every single day as a reminder. I wanna show you what a beautiful little girl, 8-year-old, Ava, has drawn. I’ve got many pictures from her. This is a child with a brother and a wonderful family, whose family has been absolutely devastated by the amount of money they lost. And their children, at their young age of 8, understand the calamity this cost.

This is affecting families all over the world, but we know of 65,000 Americans - and that’s what we know of. We know of that because of the internet, because of social media.

The MMTLP family is one that I’ve never experienced on the internet. This group of people is organized, determined, lawful, and doing what we all should be doing. Its their civic duty and they’re governing. Coming together and holding regulators responsible for their completely unlawful actions. The ignorance of their own statutory law. The fact htey’ve ruined lives to protect the people on Wall Street who stole from the investors. Imagine walking into a bank and stealing a million dollars, and when you get out, someone walks up to you and says, “Shame on you, if you pay me $100 in a fine, you can get off Scot-Free. Wouldn’t you do that every single day? Thats what Wall Street did to MMTLP - and its going to stop”

Now, she apologizes for the technical difficulties in the beginning, and wants to go back to 2014.

And two companies that decided to merge. When they did and did a reverse merger, they spun out a Series A dividend called MMTLP. That dividend was opsistioned for those members which owned MMTLP to get a share of Nextbridge Hydrocarbons, coming from the reverse merger. And then they filed their securities, their paperwork with the SEC, the market makers, Wall Street, the Broker-Dealers, got togehter and said oh my goodness, we have sold so many fake shares of MMTLP in the last year and made millions or billions of dollars doing it that there‘s no way they can get those fake shares to transfer to the spin out. They were going to get caught with their pants down in naked short selling, illegal. So they positioned through their own trade association, they sent emails, and we have copies of those emails. Basically explaining, “hey, we have naked short sold this particular ticeker, we’re going to get caught,” so the SEC held up the S1 filing, because what the S1 filing was going to do? IT was going to request all of the shares to come home under the own transfer agent of the new company coming out, and that transfer agent would be able to match up the existing shares to a new share. But because so many synthetic fake shares were sold, there was no way to do that.

So the Wall Street companies petitioned the SEC and we have the emails to stop that S1. That is what’s going on in this institution right here. That is not representing you, that is not protecting you.

Standing behind me are victims of the MMTLP fiasco. In front of me is the MMTLP army. The most exceptional group of people i’ve ever seen. Truly the government of this country and they’re doing it efficiently, lawfully, and frankly quite beautifully. I‘ve never seen anything like it in my life.

Next up (my friend!) Michael. To give his story.

A fire truck goes by and its hard to hear. then he starts

If you haven’t heard of MMTLP, you might just think this is a random stock. Who cares? Companies disappear all the time. But it’s actually not true. This affects everyone.

Most people are out there working hard and were told to add to a 401K, right? For example, there was a switch between when you used to get annuities when you retired, then they switched that to 401k’s. And there was a lot of media to try to say that was a great thing. But really, it opened up the door for a lot of fraud.

What you see now, with this MMTLP group, and other investors like me - I’m not an MMTLP shareholder, I’ve just found they’re fighting the same good fight as I am, so I stand shoulder to shoulder with them

me too

These are the people who are doing the job…

suddenly hte mic/sound goes out.

It’s back.

These different stock communities: MMTLP, Bed Bath and Beyond, GameStop. To hear those individual stories, its something that is unbelievable. We kinda of expect that the SEC and these different regulatory bodies are doing their job. We get fired if we don’t do our job. But for them, if they don’t do their job and help criminals get away, they get a cushy job after they leave here. They go work for some hedge fund and make lots of money.

He tells his story about buying Intel, they were promised more money from the government, yet the stock tanked.

Then he started doing his own research, more research. Then, fast forward some time, he was trying to evaluate different companies. The CEO of Bed Bath and Beyond came out. We all know BBBY, they were the biggest retailer for home goods, they were doing billions of dollars of revenue. She came out and said, “We have a turnaround plan, we’re going to reduce our store footprint, up our internet portion of our business…” and I started doing some calculations, it’s at 35 cents right now. Compared to other companies in a similar situation, it could be worth 6 or 7 dollars. A very reasonable evaluation to make.

Similarly with MMTLP, during COVID, people stopped driving, and gas prices went through the floor. And a a lot of oil companies suffered. People were smart and keyed into that and bought different oil companies.

These people bought MMTLP, a really smart decision.

The difference is they didn’t know there was going to be a different level of collusion, unfathomable, against them specifically. Because they thought that we couldn’t fight back. They thought that we would just, you. know? Move on. And little did they know, three years later, here we’d be. So, the thing is that we’ve been, each one of these communities has been doing the work that the SEC should be doing. IT’s a lot harder for us because we don’t have all of hte the tools that we have.

In the case of Bed Bath and Beyond, the CEO came out and had a turnaround story, and then literally like weeks later, they go into bankruptcy. Even though they had an alternative route. In the bankruptcy, the lawyers for the company said the CEO had no idea what she was talking about and hadn’t been involved with the company in weeks.

Luckily, there has been some justice in that area and hopefully that goes through. But the reason this is important is that anyone who had a 401K… a lot of these stocks, like BBBY were a portion of that 401k. So when these companies were systematically targeted and cannibalized, it affected everyone. Your 401k did not go up as much as any of these financial institutions. They’ve been making money hand over fist.

It’s crazy to me that we’re out here doing the heavy lifting, exposing the crime, trying to get resolutions, trying to fix the things that have been intentionally broken so that the criminals can get away with murder. And yet, the SEC… they made, after MMTLP, AMC, GameStop - they turned off the buy button for GameStop, nothing happened for anyone, right? - and instead, what they did, instead of going after the criminals, they paid half a million dollars to make videos to make us look bad. The people who are actually doing THEIR job, for the American people, they made videos to make us bad. And then paid lots of money to push it out to everyone. So that everyone, when they hear about this kind of thing happening, they don’t believe us. They think we’re crazy.

There are a lot of really, really important fights going on . If you don’t know how big the crime is, all you have to do is a little big of digging becuase its everywhere. People hear GameStop and they’re like, “oh, that’s a memestock.” Why is it a Meme stock? There are so many people that the fraud is so glaringly obvious. When you actually look into it, it really makes you motivated. With GameStop, it was reported. There’s a lot going on that there’s, you know, you can borrow a share. There was reported short interest; for every 1 share that was supposed to exist, there were 3. Even just right now, there’s an ETF called XRT, which has all of the retail stores in it. For every 1 share, there are 3.

Its been that way for six years. How is that possible? Why, when a company issues a certain number of shares, someone should be making sure that number is not being inflated, doubled, tripled.

There is all this fraud, and none of us would have guessed that the fraud went all the way to the top. We thought that maybe the SEC didn’t believe us, but with the recent developments in MMTLP, they found that the collusion goes right into the SEC. That they were actually colluding against us. Which is unbelievable. This deserves a lot of attention, and it’s going to help everyone. Everyone that has a 401k, all of America, all of America’s companies. I’m glad to stand with all of these people. Thank you very much.

Next guy (a veteran) says:

The SEC does not want to give us the transparency we deserve. What are they hiding? We’ve been here for three years.

You have 74 signatures on a document signed by bipartisan congressional members. Why is Congress not requesting the blue sheets we know exist?

If we were so wrong, why hasn’t the SEC made it extremely clear to Congress, said, “these people are wrong, here are the blue sheets, let them go away?”

We’ve been here 3 years fighting, and we are strong.

We have to stand up for the veterans and brothers and sisters who were harmed.

I will not give up on you.

NEXT GUY (a veteran)

- This is baffling and astonishing that this is happening. This is fraud. A different version of a Ponzi scheme.

- It doesn’t matter how you cut it, the way you look at it.

I constructed the MMTLP dashboards. From there, you have a foundation of what has happened, timelines, and documents from our favorite people here

Why has the SEC processed 34,000 foyas from 2022 till now? They’ve released in full or denied in part only 11.8% to the entire sector… yet with MMTLP we only get 0.8%? Why is that?

We see a peephole, a pinhole of foya documents. We don’t see anything. And yet the rest of the market sees 11.8%.

Most people can not fathom how deep this rabbit hole goes.

It falls hand-in-hand, and with silver, GameStop, amc, with many other stickers.

My goal is to fight this until the end of it. If you don’t want ot fight, get out of my way. We’re going to take this to the end, finish this where it needs to go until it’s resolved in one fashion or another.

Whatever I have, I provide to anyone who is asking for it.

Up next is a woman.

I never imagined I’d ever be standing here. Like most Americans, I believed in the Capital Markets; they were fair, and regulators could be trusted.

When systems failed, elected representatives would step in and protect the people they served.

We’re here today because those beliefs were proven false. Here today to advocate for senior citizens in these communities.

Address a narrative that has been constantly used to dismiss retail investors. We’ve been told we’re irresponsible, uneducated, uninformed, reckless, that we are dumb money. That tired narrative is a form of gaslighting. A convenient way to blame retail investors instead of confronting the fraud and corruption that plagues our capital markets.

For decades, investing in the American stock market was considered prudent. It’s how families planned for the future, how parents built financial security, how people tried to do right by their children.

I grew up the youngest of nine children. My parents invested in the stock market throughout my entire childhood. They made sacrifices so they could invest. They believed the system worked - not perfectly, but fairly. And like many families, we benefited from the investments my parents made. But sadly, that is no longer the case for families investing in today’s capital markets. So when people say to retail investors, “you shouldn’t have invested more money than you could afford to lose” is what they’re really saying that ordinary Americans should not expect fairness in their own markets. That when fraud happens, its someohow our fault and that we should just simply expect it.

In reality, we’re fighting on behalf os sharehoders whose only mistake was believing in the American financial system and the people entrusted to run it. What happened to MMTLP was not reckless, a bad debt, and most certainly not our fault. This was a corrupt market that allowed overselling, naked shorting, and froze investors in place. When the severity of the situation became known.

And when a highly informed, determined grassroots group of investors from across the country and around the world came together to ask questions, to do research, and apply pressure, the system shut down questions instead of providing answers. They circled the wagons to hide the truth. Regulators shut their doors, our elected representatives turned their backs, and that is the backdrop of the MMTLP situation and the effort to discredit and silence retail investors.

Her grandma was born on the 4th of July and has loved this country her entire life.

When regulators stall, delay, and hide behind “ongoing investigations,” it’s simply a delay tactic. And “time” is something that senior citizens simply do not have. There are senior citizens in this community facing serious health challenges, financial hardships, and real fear.

People who invested carefully late in life and now live in constant uncertainty and stress, this should have happened to them. This is not about money; this is about what happens when regulators and elected leaders protect powerful players; hedge funds, market makers, insiders, and Wall Street billionaires. While everyday Americans are told to wait, accept your losses, or just simply go away.

It’s a system where regulators show more concern with protecting each other and their future employment prospects on Wall Street than protecting the public they are supposed to serve. If those decisions were truly justified, they would not fear transparency. If those actions were something to be proud of, a full share count would not be refused. And if elected officials truly worked for the people, they would not ignore seniors who have been asking for help for more than three years. We’re not asking for special treatment, we’re asking for the truth, for accountability, and for markets for hard working americans not blamed for simply investing. We’re not reckless; we were betrayed and we are not going away.

I’ll stop blogging from here. If you want to watch the rest, the link is here again. https://x.com/annvandersteel/status/2010727387663827031?s=20

I just want to say that I’m so hopeful for the future, for accountability to kick in, and honored to stand with the retail investing community. I want to see these crimes accounted for and for the stock market to be an honorable system.

Until next time, I wish you the motivation and success to search for opportunities around your area. Search and explore: Who is out there giving talks? There are new things happening all of the time.

Find relatable or interesting topics you like and check them out! Maybe even something hosted at a cool venue, if there’s no other reason to go. Let’s see what you can learn and discover not too far from home. 😊